10 Steps for Estimating Rehab Costs When Using the BRRRR Method (and one SIMPLE budgeting shortcut secret)

At Boise TurnKey, we offer a wide variety of different investing methods, most often through turnkey investing and the BRRRR method: Buy-Rehab-Rent-Refinance-Repeat. Today, we'll be focusing on the second R: rehab.

Rehab is a hefty step in the process and can feel really overwhelming. Often, getting started on a solid foot is the hardest part with the most complexity; one of the most critical aspects of renovation is accurately estimating rehab costs. This way, you can plan your budget effectively, and avoid any unwelcome surprises. Our goal here is to take the scope of the project and narrow it down by giving you a simple guide to kickstart your rehab process and keep things simple.

Here are 10 steps for Estimating Rehab Costs.

1.Look at the buyer and the neighborhood.

Before you get started, have an idea of the end product and whether or not it will fit in the garden you're planting it in. Is it a vegetable among a raspberry patch? A good thing on its own but out of place where it is? Rehabs are a little like that.

Ask questions about what you're planning– a high end remodel, or just a cosmetic renovation? What do you actually need? Does it fit in the neighborhood you're in? What sorts of people live there? Attend other open houses in the area to see what the standard is: will below-market finishes in a wealthy neighborhood result in a house left empty? Or will a luxury remodel in an inexpensive neighborhood result in buyers unwilling to pay extra, leaving your property lingering in vacancy?

What sort of homes are in the neighborhood, and what do those homes need in order to be competitors in the market? Answer those questions first, and then jump in.

2. Evaluate the scope.

Once you understand what sort of remodel you're undertaking, make a list (bathrooms, kitchen, flooring, electrical, plumbing, etc.) What needs to be replaced/redone/remodeled, and to what extent? Walk through the property very slowly, taking photos and videos to help jog your memory as you plan and execute later. Be extremely detailed, and don't cut corners. Be honest about what needs work, so you're not unpleasantly surprised later. Go through each room and write down potential problems in each room, and finish with the exterior, taking note of roof, siding, etc.

This finished list detailing which rooms need work and to what degree will provide a clear roadmap as you move forward, and help you to make the most accurate estimate for your budget.

3. Make a spreadsheet

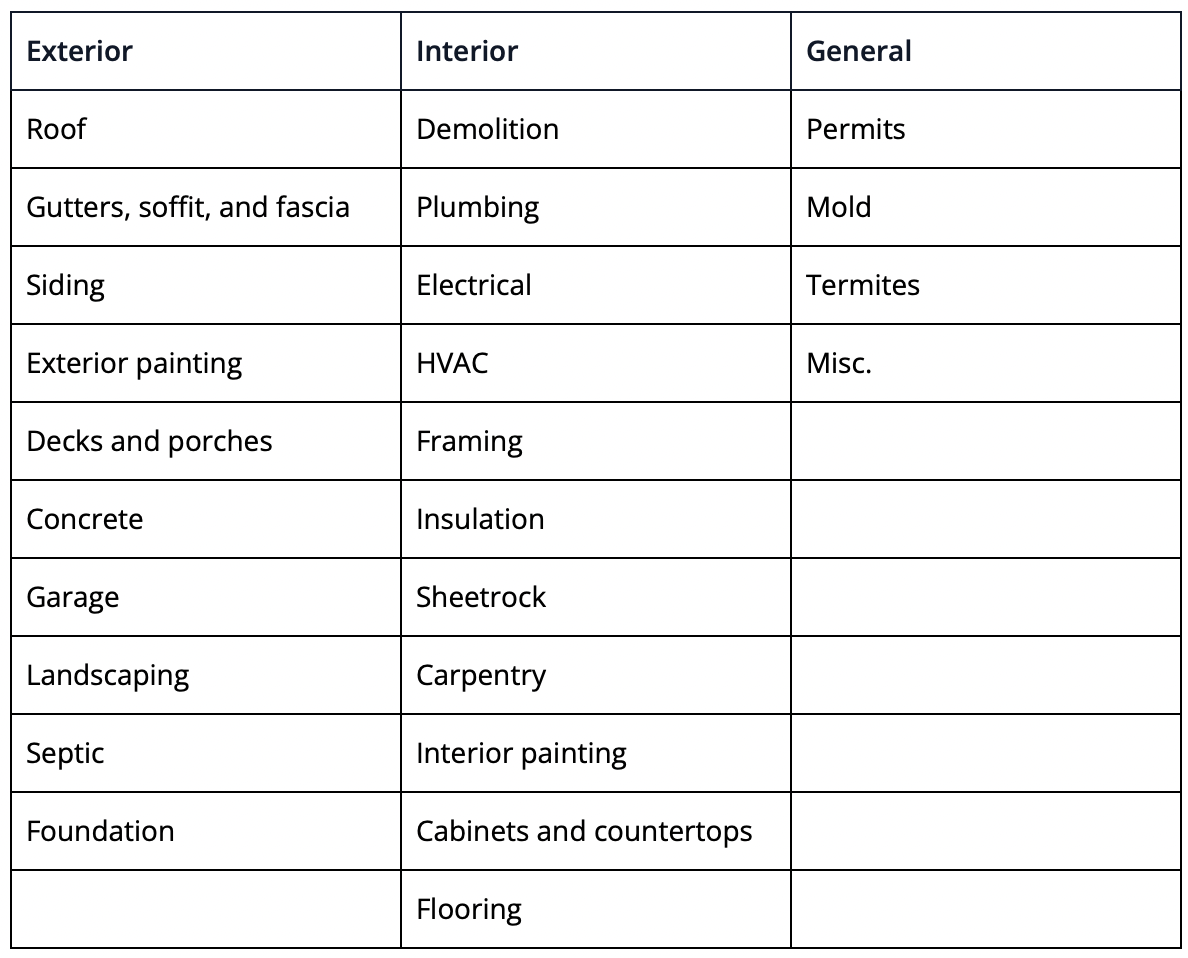

Bigger Pockets has created this spreadsheet of 25 categories to organize your list, which encompasses every element of the rehab process. Utilize this to ensure nothing falls through the cracks (pun intended).

4. Research and gather information.

Once you're clear on what you need to do, start your research. Going through your spreadsheet one category at a time, take a thorough look at materials at home improvement stores and online marketplaces. Make calls to contractors, and do online research. If you're planning on doing multiple rehabs in your investment journey, make a second spreadsheet of each repair cost, including final receipts, quotes, and other details you want to remember so you only have to do this work once!

Boise Turnkey is consistently rehabbing properties, and we are always happy to either help you along the way or simply manage the entire process for our clients. The contractors we work with seasoned contractors that are reputable, and in many cases, have been our partners for well over a decade.

5. Determine material costs.

We recommend spending a good amount of time in person in home improvement stores, especially if you're beginning your journey. This will give you a good idea of how much materials typically cost, which will help you see how much you should be paying contractors, or where you're getting the best bang for your buck. Research different suppliers and factor in the quality, durability, and price variations. Better quality materials will cost more (as you would imagine), but don't just settle for the cheapest materials. If you want your rehab to be beautiful and functional long-term, make the necessary sacrifice and purchase better quality materials. The last thing you want is to replace today’s work and expenses again in three years.

6. Determine labor costs.

For a rough estimate on labor cost in labor, we suggest doubling the price of the materials. If you work with a contractor, they can provide you with updated costs for each rehab task. If you plan to hire professionals, obtain multiple quotes from licensed contractors with a solid reputation.

Look for reputable contractors who are experts at what they're doing. You can use an online contractor platform, or approach contractors yourself through online searching. Get at least three quotes, and don't necessarily just pick the cheapest one. There's probably a reason they're the cheapest…trust us, we’ve learned that one the hard way. It’s a rite of passage! Consider experience, expertise, and reviews most of all, and ask your friends who have done similar projects who they used, how much it cost them, etc.

Alternatively, if you're confident in your own abilities, you can estimate labor costs based on the time required for each task and apply a reasonable hourly rate. Another way to estimate rehab costs, should you decide to do the work yourself, is to multiply the rehab cost per square foot by the size of your property. This doesn't work all the time (for plumbing/HVAC upgrades, etc.), but it is a great way to get a loose idea of how much the rehab will cost you.

7. Create a contingency budget.

You'll want to plan a contingency budget anywhere between 5-15% of the quoted price. This ensures that you're not surprised later on as unforeseen costs crop up, such as structural damage or plumbing problems, and results in peace of mind (and potentially a happy surprise at the end of the project if you don't actually need it.) Our team always highly recommends a professional inspection before you purchase a property, which should eliminate any big, nasty surprises.

8. Permits and Professional Fees:

Check local building regulations and determine if your remodeling project requires any permits. Research the associated fees and factor them into your estimation. Additionally, if you plan to hire architects or designers, don't forget to include their fees in your budget. Keep in mind, the property owner cannot obtain permits for skilled trades unless the property is their primary residence, so you will still need to hire out HVAC, plumbing and electrical.

9. Time Frame:

When do you need the rehab done? If you need the job done quickly, expect to pay more, and keep in mind, doing the work yourself might save you money up front, but holding costs may destroy any savings. Also, remember that a drywall job that can take you a week to complete would likely take a pro one day.

10. Ongoing maintenance and upkeep:

Don't overlook the long-term costs associated with maintaining your remodeled home. Consider any additional expenses for routine maintenance, repairs, or upgrades that may be required after the project is complete.

BONUS BUDGETING HACK:

There is a shorthand for budgeting rehabs that we’ve come up with, that we've found works really well when analyzing a deal at a high level to see if the numbers work:

For a “lipstick rehab” which is generally flooring, paint and some upgraded hardware and light fixtures, you can estimate a budget of approximately $10 per square foot when working with a reasonable general contractor.

For a heavy remodel- new kitchen, baths, etc, you can estimate approximately $20 per foot.

As you prepare for your rehab, reach out! We'd love to walk through this process with you, or simply give you the help you need as you estimate how much you should plan to budget. Questions about funding or loans? Give us a call at

208-957-0870 to start the conversation.